Invest in Fidelis government bonds

,

directly from BT Trade

With us you can subscribe Fidelis government bonds in lei and euro with 0% commission, 100% online.

Open online accountEssential information for blood donors

If you want to benefit from the installment dedicated to blood donors, in addition to your ID card, you need to have proof of donation made since September 1, 2025.

Subscription threshold

The minimum subscription threshold is 5,000 lei, 1,000 euro or 500 lei, 100 euro in the case of the tranches dedicated to blood donors. For donors there is a limit of 100,000 lei , respectively 20,000 euro/subscriber.

Interest

2 years donor

2 years

3 years

4 years

5 years

6 years

10 years

RON

7,15%

6,15%

n/a

6,75%

n/a

7,25%

n/a

EURO

n/a

n/a

3,60%

n/a

4,50%

n/a

6,00%

How do you buy Fidelis government bonds?

You have two simple options, choose what suits you.

Online via BT Trade

Download the BT Trade app from the App Store or Google Play, open an online account and you can buy Fidelis government bonds in lei and euro.

You live in a BT unit

For government securities in lei, you can simply go to any Banca Transilvania branch with your identity card.

Useful documents

February 2026

Final terms

Issuance in lei with a 2-year maturity

2-year RON issue - blood donor

Issuance in lei maturing in 4 years

Issuance in lei maturing in 6 years

3-year euro issue

5-year euro issue

10-year euro issue

Offer

Base prospectus for the government securities issuance programme exclusively for retail investors

Announcement - Fidelis 2026 Government Securities Issuance Program

MF press release regarding the Fidelis offer in February 2026

Target market

BT Trade

What do

you need to know about government bonds?

If you buy Fidelis government bonds, you should know the following

Fidelis shares on the stock exchange

In 5 minutes you have the scholarship at home, on your phone.

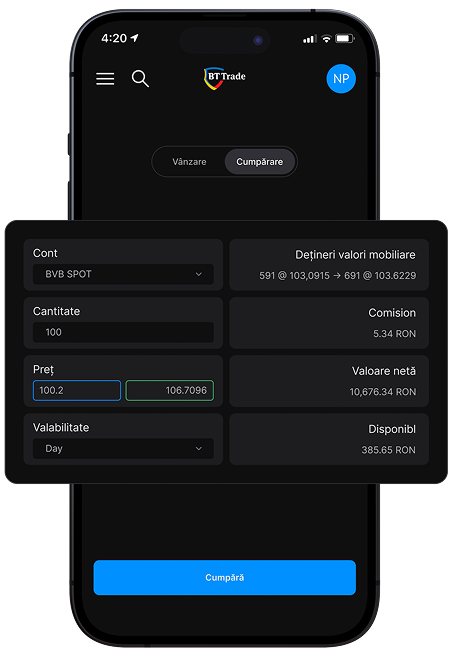

Transaction value

When you buy or sell Fidelis government bonds on the stock exchange, the total value of the transaction includes the interest accrued up to that point.

100.2

106.7096

Trading price.

The transaction price plus accrued interest to the day.

Find out what it costs

You can test directly from BT Trade, simulate a purchase or sale without finalizing the transaction. That way you can see how much it would cost you before you make the last click.

Trade quickly

When you've made up your mind, you place your buy or sell orders directly in the app and they're immediately placed on the exchange.

Quick help

All questions on questionsBTGovernment bonds are issued by the Ministry of Finance and are intended to finance the state. Fidelis government bonds are an alternative to bank deposits and are aimed at investors who take a low risk but have a medium tolerance for loss/decline of the amount invested.

With Fidelis government bonds, you have access to the money at all times and you can sell only part of your Fidelis government bonds to take possession of only part of the total amount invested. The nominal value of a Fidelis government bond is 100 lei for the lei issue and 100 euro for the euro issue, and the minimum subscription threshold is 5,000 lei, 1,000 euro and 500 lei respectively, 100 euro in the case of the tranche dedicated to blood donors.

An investment in government securities also involves certain risks related to legislative changes, changes in tax legislation, changes in interest rates or in the market price of these financial instruments.

Invest smart in Fidelis government bonds! For more information, you can contact us at fidelis@btcapitalpartners.ro or on 0374 77 88 77.

Take control of your investments straight from the app

Scan the QR code and download BT Trade.